The following article will discuss what options trading in the stock market is and how to trade them. We will look at trading strategies for buying and selling options with examples, discuss what Put and Call options are, and much more.

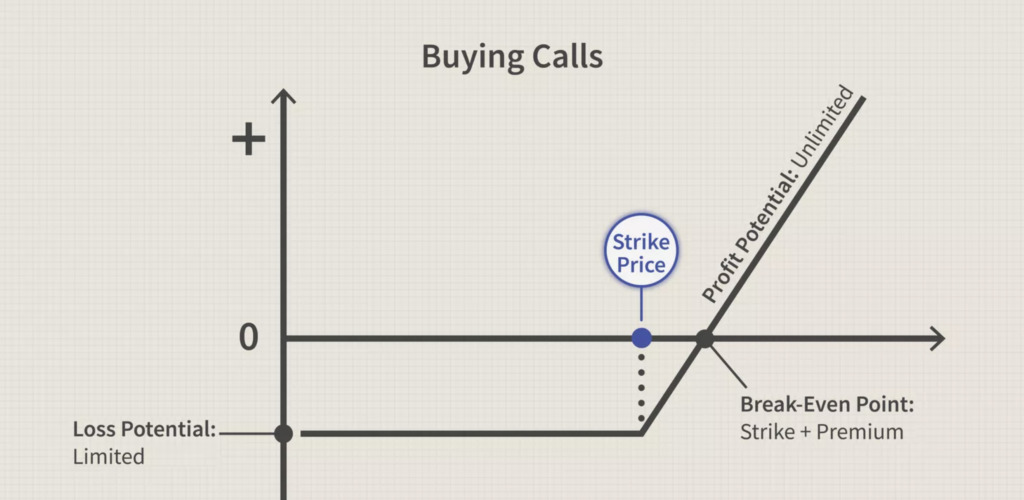

Buying Calls (Long Calls)

Trading options have several benefits for beginners and pros wishing to place a directional bet on the marketplace. You can purchase a call option with less capital than the underlying value if you believe the asset’s value will increase. If the value decreases, however, the losses are strictly restricted toward the premium paid for options.

The following traders might favor this approach:

- Want to use leverage to profit from price increases

- Want to reduce risk yet are optimistic or ‘Bullish’ in a specific exchange-traded fund, index fund, or stock

Options are basically leveraged commodities since they enable investors to increase the possible upside profit by investing less money than would typically be necessary to market the underlying stock. Therefore rather than spending $20,000 to purchase 200 shares of a $200 stock, you might conceivably pay $4,000 to buy a call option with a market price that is 10% higher compared to the present market value.

For example, a trader wishes to invest five thousand dollars into Coca-Cola, which is now selling at about $165 for each share. They can spend this money on thirty shares for $4,950. So let’s say that the commodity’s value rises by 10% during the following month, reaching $181.50. The investor’s portfolio will increase to $5,445 after deducting all brokerage commissions or processing fees, giving him a net dollar gain of $495, approximately 10%, on his initial investment.

Let’s imagine that perhaps the value of a call option on the equity with a $165 market price expiring roughly a month is $505 for each contract or $5.50 for each share. The trader could purchase nine options at $4,950 using their allotted investment budget. The trader is executing a transaction on 900 shares since the option contract holds a hundred shares. The option would expire in ITM and be worth $16.50 for each share (for a $181.50 to one sixty-five dollar strike), or $14,850 on Nine hundred shares if the stock value rises 10% over $181.50 at expiry. Compared to investing the underlying asset immediately, this represents a far greater yield of $9,990 in net dollars, or 200%, on the investment made.

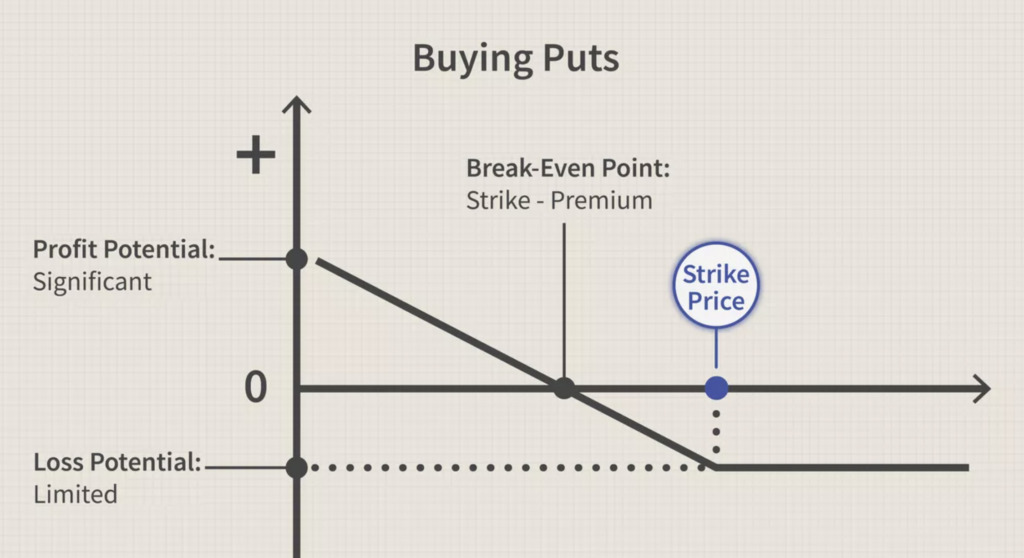

Buying Puts (Long Puts)

A put option provides the right to trade the underlying at a certain price. In contrast, a call option offers the investor the opportunity to purchase the underlying at a predetermined price before the deal expires. The option buying strategy is the best option trading strategy for those who:

- Wish to use leverage to benefit from declining pricing

- Are bullish on a specific ETF,index, or stock but desire to avoid the risk involved in short-selling strategies

When compared to all options, put options function precisely the other way, increasing in value when the price of the underlying falls. The risk associated with a short position is endless since there is potentially no upper bound according to how significant a price might increase, even if short-selling enables a trader to gain from declining prices. If the underlying value exceeds the strike value of a put option, the option would automatically expire.

For instance, you believe that a stock’s value will drop from $70 to $60 or below due to poor earnings, but you do not want to take the chance of selling it short if you are mistaken. Instead, you can pay a $2.00 premium to purchase the $60 put. The maximum you would lose is the $2.00 premium if the price does not drop under $60 climbs instead.

Therefore, you would profit $5 ($60 minus $55. less the $2 premium) if you are correct and the value falls to $55.

Risks and Rewards

A long put’s possible loss is capped at the premium for the options. Since the underlying value cannot go under zero, the position’s potential gain is limited. However, the put option amplifies the broker’s return to a long call option.

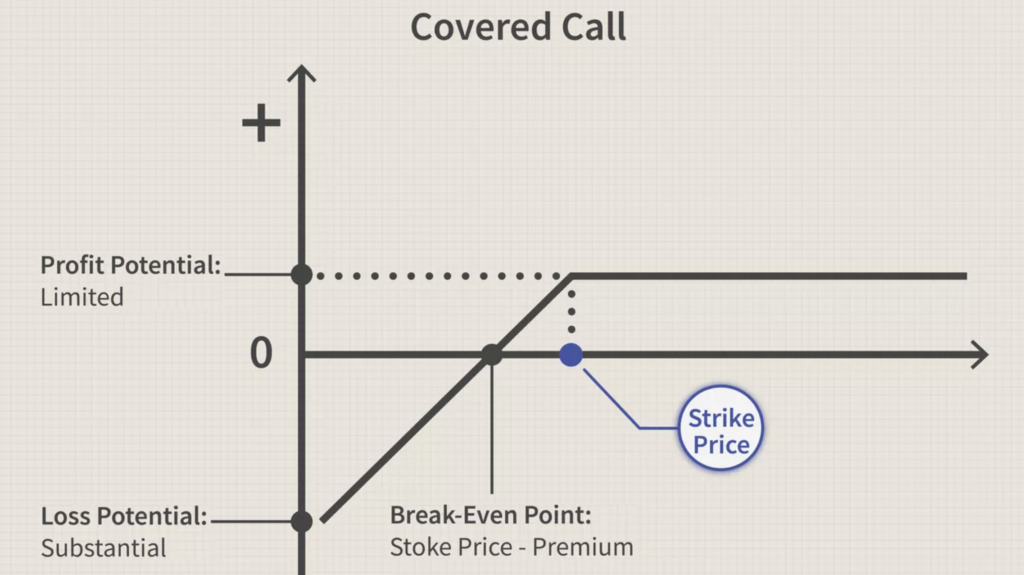

Covered Calls

A covered call refers to a strategy added to a current long position within the underlying asset, opposite to a long put or a long call. In essence, it’s an upward call that is traded at a price equal to the size of the current position. By doing this, the covered call writer restricts the potential upside of the underlying position while simultaneously collecting the option premium as income.

This he the best option strategy for brokers who:

- Anticipate the underlying’s value to remain the same or slightly increase, earning the whole option premium.

- Prepared to trade some downside risk for a cap on possible upside

Purchasing 200 shares of an underlying asset and then trading a call option in exchange is a covered call strategy. The cost basis of the shares decreases, and some loss protection is provided whenever the trader trades the call and collects the option’s premium. The trader’s upside potential is capped by committing to trade shares of the underlying at the option’s market price in exchange for selling the option.

For example, consider a scenario in which a broker purchases a thousand shares of BP at forty-four dollars a share. Next, if the broker concurrently sells Ten call options (1 contract for every hundred shares) with a strike value of $ forty-six and an expiration date ending within a month for $0.25 each share, or $25 each contract, as well as a sum of two hundred and fifty dollars for the Ten contracts.

The $0.25 premium lowers the cost model on the shares to $43.75. Therefore, any decline in the underlying up at this stage will balance by the premium obtained from the option strategy, providing only little downside defense.

The short call option will be called away in case the share price increases over $46 before expiration, in which case the broker will become obligated to deliver the shares at the option’s strike value. The trader will benefit by $2.25 for each share throughout this instance. This example suggests that the broker does not anticipate BP will rise considerably over $46 or lower than $44 during the upcoming month.

The broker will receive the premium clear and free and may continue to sell calls against the shares if wanted in case the shares don’t increase beyond $46 and aren’t called away prior to the options expiration.

Risks and Rewards

The short call option could be executed, requiring the trader to provide shares of the underlying at the option’s strike value, regardless of whether it is just under the current market value, even if the share value increases above the strike value before reaching its expiration. Therefore, a covered call strategy offers a minor amount of downside defense in return for this risk in the shape of a premium obtained when trading the call option.

Protective Puts

Purchasing a downward put by paying an amount large enough to cover the current position in the underlying commodity refers to a protective put. This strategy effectively lowers the floor under which you can’t lose any more.

Of course, you will be required to make a payment for the premium for the option. This enables it to function as damage insurance. This would be the ideal strategy for brokers who hold the underlying asset and seek downside defense.

Therefore, a protective put is much like a long put, similar to the strategy discussed above but, contrary to what the name suggests, the objective is to shield against a negative move rather than attempt to make money from one. A trader who holds shares with a favorable long-term outlook but wants to hedge against a short-term downturn may buy a protective put.

When the underlying value rises and exceeds the put’s strike value when the option matures and expires, the trader forfeits the premium while reaping the benefits of the higher underlying value.

However, this loss becomes significantly offset by the profit from the put option position. In contrast, the broker’s portfolio position drops if the underlying value declines. As a result, a position is a form of insurance.

To lower premium payments at the risk of diminishing downside defense, a broker can place the strike value lower than the current value. This is comparable to deductible insurance. Consider a scenario where shareholders purchase 1,000 shares for $42 and wish to safeguard their investment from negative price changes over the following two months. There are several put options they could follow:

Example: Protective put

| May 2022 options | Premium |

| $42 put | $1.25 |

| $40 put | $0.45 |

| $38 put | $0.18 |

The chart demonstrates that as protection levels rise, so do the associated costs. For instance, the investor can purchase ten at-the-money put options with a strike price of $42 for $1.25 per share, or $125 for each contract, for an overall cost of $1,250 should they wish to safeguard their investment from any price decline. However, selecting a less expensive OTM option like the $38 put might also be successful, provided the investor is prepared to accept some possible losses. In this scenario, the price of the option position may only be $180.

Risks and Rewards

The potential loss is restricted towards the option premium, which would be paid like insurance if the underlying’s value remains flat or increases. The loss of money, however, is restricted to the gap between the starting stock value and strike value and the option premium paid. It will be compensated by a rise in the option’s value if the underlying’s value drops. To the strike price of $38 in the example mentioned above, the damage is capped at $4.18 per share ($42 – $38 + $0.18).

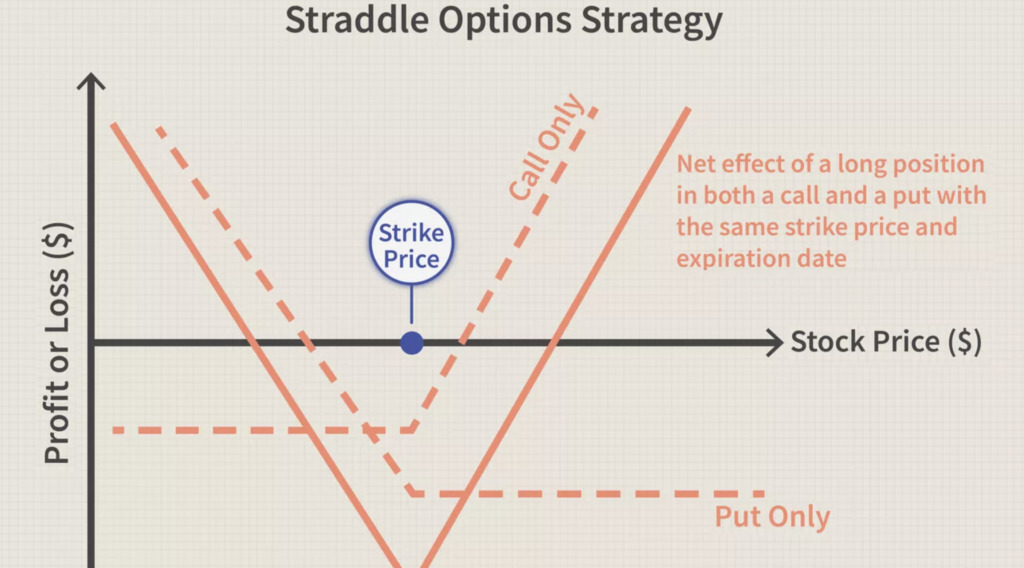

Long straddles

By purchasing a straddle, you may profit from upcoming fluctuation without guessing if the movement would be upward or downward since either way will be profitable.

In this case, a trader purchases a put option and a call option on the same underlying at the identical strike value and expiration. It costs more compared to other strategies since it calls for buying two at-the-money options.

For example, a person who anticipates significant price swings in a particular stock after a financial results on February 16. The stock is now trading for $101.

The investor buys a $5 call option and a $5 put option, with an expiration date of September 5 and a strike value of $101.This straddle has a $9 net option premium. In case the value of the underlying securities at expiry was more significant than $111 (the net option premium + strike value) or less than $90 (the net option premium – strike value), the trader would make a profit.

Risks and Rewards

A lengthy straddle could only lose the utmost of its purchase price. However, it may cost more than a put or a call since it includes two options. The maximum gain is restricted only by the strike value on the downside and potentially infinite on the upside. For example, if you possess a $30 straddle and the stock value drops to 0, you can only profit by $30).

Some basic other options strategies

Most inexperienced investors or brokers can use the simple strategies described here. However, note that more sophisticated approaches are available than just buying options like puts or calls. Although a lot of these sorts of strategies are covered elsewhere, the option trading strategies below are simply a quick overview of some other standard options positions that are appropriate for individuals who are familiar with the ones covered above.

Vertical Spreads

This refers to the concurrent purchase and sale of options with the same kind and expiration date (e.g., puts or calls) but with distinct strike values. These may be built as bear spreads or bull spreads that will benefit whenever the market moves in one of those directions. Since you receive the option premium from each traded one, spreads are less expensive than a long put or long call. This also restricts your potential upside to the distance among the strikes.

The married put strategy

This strategy requires purchasing an ATM put option in an amount sufficient to fill a current long position in the stock, much like the protective put approach. This is how it resembles a call option (sometimes called a synthetic call).

Protective collar strategy

This strategy requires an investor with a long position in the underlying stock to purchase an out-of-the-money put option (e.g., on the downside) and simultaneously write a call option that is in-the-money (e.g. on the upside) on the identical stock.

Long strangle strategy

The purchaser of a strangle simultaneously goes the distance on a put option and an out-of-the-money call option, much identical to the straddle. Despite their differing strike values, they will both have the exact expiry date. The call strike value ought to be higher than the put strike value. Compared to the straddle, this needs less premium investment, but to be successful, the commodity must go either greater to the upside or less to the downside.

Advantages and disadvantages of trading options

The primary benefit of purchasing options is the substantial upside potential and the little maximum loss of the option’s premium. The downside to this is that if the stock somehow doesn’t rise sufficiently to be in the money, the options would expire. This indicates that purchasing several solutions out of the money might be expensive. Options may be an excellent tool for risk management and obtaining leverage.

For instance, a bullish investor with $2,000 to invest in a business may generate a far higher yield by acquiring a $2,000 value of call options on that company rather than $2,000 worth of the company’s stock. Investors can utilize their position by raising their purchasing power using call options. Alternatively, if the investor already owns stock in the firm and wishes to decrease that risk, they might hedge their risks by selling put options against the company.

Options contracts’ major drawback is that they are intricate and hard to value. Due to this, options are frequently seen as a more sophisticated investment tool, appropriate primarily for seasoned investors. They have gained more and more popularity recently among ordinary investors.

Investors must understand the possible ramifications before investing in any options positions because of their potential for disproportionate gains or losses. Devastating damages may result from failure to comply. Selling options also carries significant risk since you assume potentially infinite risk with gains capped at a price paid for the option.

What are the levels of options trading?

Depending on the degree and amount of risk, most brokers grant several levels of authorization for trading options. The two most fundamental levels, levels 1 and 2, would encompass all four strategies mentioned here. Customers of brokerage firms will generally need to hold a margin account and have authorization for options trading within a certain threshold.

Level 1: Protective puts and covered calls when the investor already owns the underlying asset

Level 2: Long call and put option trading, including straddles and strangles.

Level 3: Options spreads, where one or more options are purchased while one or more options of the same underlying are sold simultaneously.

Level 4: Writing naked options, which are unhedged and have the potential for limitless losses.

How can I start trading options?

The majority of internet brokers currently provide trading options. Typically, to trade options, you must apply and receive approval. Additionally, a margin account is required. After receiving approval, you can place trading orders for options like you might for stocks, but by utilizing an option chain to specify the underlying, strike price, expiration date, and whether the order is a call or a put. After that, you can use limit or market orders for that choice.

When do options trade during the day?

Equity options are traded within regular stock market trading hours. This usually occurs from 9:30 am until 4:00 pm EST.

Where do options trade?

Listed options are traded on specialist exchanges like the ones mentioned below:

- The Boston Options Exchange (BOX).

- Chicago Board Options Exchange (CBOE).

- International Securities Exchange (ISE).

Orders sent through a broker will be sent to one of the above exchanges for better execution as they are now entirely electronic.

Can you trade options for free?

While many brokers now provide commission-free trading in ETFs and commodities, there are still costs or charges associated with trading options. Generally, there will be a charge on each transaction (for example, $3.95) and a commission per contract (for example, $0.50 per contract). Therefore, your cost would be $3.95 + (10 x $0.50) = $8.95 if you purchased ten alternatives at this price point.

The bottom line

Options provide many ways for investors to make money by trading the underlying securities. You can utilize mixtures of options, underlying assets, and other commodities in various approaches. Buying puts, buying calls, purchasing protected puts, and selling covered calls are fundamental trading options for dummies who are just learning the stock options trading basics.

Options trading offers benefits over actual trading assets, like leveraged profits and downside protection, but it also has drawbacks, like the need to invest the premium in advance. Selecting a brokerage is the initial stage in the options trading process. Before starting options trading, traders must ensure they understand everything so they do not make any errors. Proper education in options trading is critical for success since one error may cost you a lot of money.